14 Nov, 2017/ by Surveyor Local /News

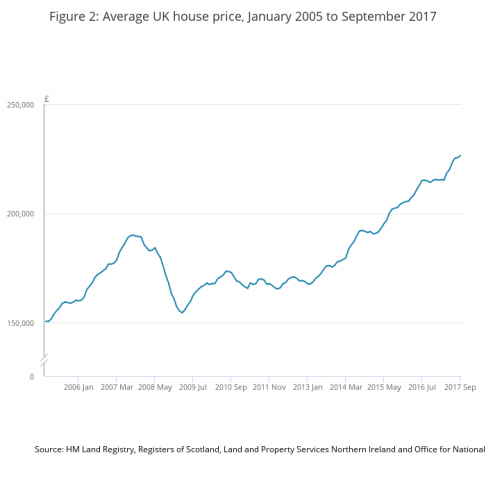

The average price of a property in the UK is now £226,367, up 5.4 percent from a year ago. The Office for National Statistics' (ONS) monthly UK House Price Index has pointed to a shift in the traditional north-south divide. The north-west, in particular Manchester, had higher price growth than London and the south-east.

The ONS figures cover the year to September 2017 and show that the average property price has risen around £11,000 in that time. In the year to August 2017, average price growth was 4.8 percent.

Meanwhile, the residential market survey from the Royal Institution of Chartered Surveyors (RICS) - whose members are part of Surveyor Local's nationwide panel of chartered surveyors - showed that both demand from buyers and agreed sales have declined again and it pointed to flat price trends.

Expectations subdued

Simon Rubinsohn, chief economist at the RICS, said: “The combination of the increased cost of moving, a lack of fresh stock coming to the market, uncertainly over the political climate and now an interest rate hike appears to be taking its toll on activity in the housing market.

“With both buyer enquiries slipping and sales expectations also subdued, the sense is that home owners are staying put and first-time purchasers are increasingly focusing on that part of the market supported by the Help to Buy incentive.

“A stagnant second-hand market is bad news for the wider economy, not just in terms of spending but also because it restricts mobility.”

1st-time buyers face higher prices

According to the ONS, the average price of a new-build property in the UK was £281,082 in September 2017, compared to £222,565 for an existing property.

First-time buyers are paying an average £190.679 for their first home, up 5.1 percent on September 2016, while existing owner-occupiers have to find an average £262,898 for a home, up 5.7 percent in a year.